Roper Acquires CentralReach (~24.7x EBITDA)

- Will Hamilton

- Mar 27, 2025

- 2 min read

Updated: 4 days ago

In March 2025, Roper Technologies announced the acquisition of Insight Partners’ CentralReach, a leading provider of web-based practice management, clinical, and data solutions for Applied Behavior Analysis (ABA) therapy and other developmental disability services. CentralReach’s integrated platform supports care providers with electronic health records (EHR), billing and scheduling, outcomes tracking, and reporting tools tailored to behavioral health and therapy practices, making it a key software solution in a rapidly growing care segment. The acquisition furthers Roper’s software expansion strategy by adding a purpose-built vertical SaaS business with strong recurring revenue and high customer retention in the healthcare IT market. Financial terms were not publicly disclosed.

The addition of CentralReach enhances Roper’s healthcare technology portfolio and deepens its presence in the behavioral health and disability services ecosystem, where demand for digital care delivery, compliance, and outcomes analytics continues to accelerate. CentralReach’s specialized software complements Roper’s existing healthcare-adjacent businesses by enabling cross-platform innovation, scale, and operational efficiencies while providing customers with end-to-end workflow solutions. This deal reflects a broader trend toward strategic buyers pursuing vertical SaaS platforms with defensible market positions, recurring revenue models, and long-term growth driven by secular trends in care delivery and practice digitization.

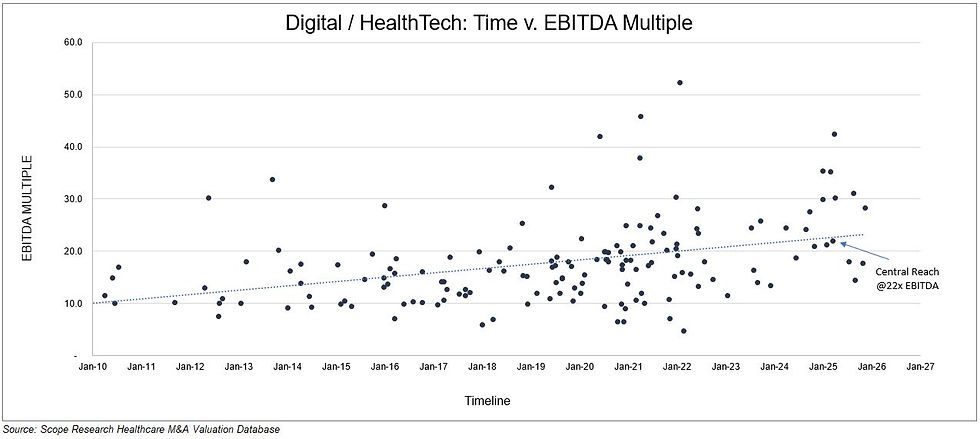

HealthTech EBITDA Multiples

The press release discloses a $1.65 billion net purchase price, which is stated net of a $200 million tax benefit, resultingin a gross purchase price of $1.85 billion. Also according to the press release, CentralReach is expected to generated revenue of $175 million, and EBITDA $75 million, implying multiples of 10.6x revenue and 24.7x EBITDA.

The implied multiple is slightly higher than the precedents, which is consistent with a general uptrend in digital health valuation multiples.

Digital / HealthTech M&A Deal Volume

The number of announced digital health deals has exploded in 2025, driven by AI led innovation. Volumes have increased from an average of 71 per quarter in 2023 and an average of 82 per quarter in 2024 to an average of 115 per quarter in 2025. Announced transaction volume in the 3rd quarter reached a peak of 135 deals exceeding the peak of 130 deals from Q1 2021. On a subsegment level, telemedicine dealmaking appears to have finally recovered after the post-COVID slow down.

Other HealthTech Deals

Read Scope Research's take on other digital health M&A transactions:

About Scope Research

The Scope Research Healthcare M&A Valuation Database currently has financial details related to 278 digital health and information technology deals, segmented by type, including 155 deals with disclosed EBITDA multiples. The digital health data can be purchased individually, while our affordable annual subscriptions provide access to all of our healthcare M&A databases and segments, updated continuously.

Don't hesitate to reach out to Will Hamilton at will@scoperesearch.co with questions about your specific situation.