Download our Healthcare M&A Review 2024

The Best Kept Secret in Healthcare M&A

Equip your team with healthcare M&A databases that capture more deals and more financial details

$200/mo

Firm-wide license

Our Database Resources

We scour public documents to capture and categorize every healthcare M&A deal that gets announced publicly in the U.S. (as well as select international transactions). We routinely review the following documents, among others, to capture accurate deal values and seller financial information:

-

Press releases

-

SEC filings

-

Medicare cost reports,

-

Publicly available audits

-

State Certificate-of-Need filings

-

Bond market research

-

Attorney general reports

-

Court documents

M&A Valuation Database

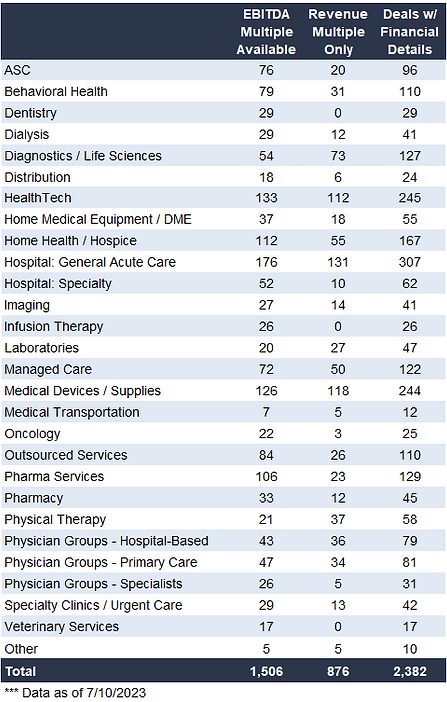

This database tracks healthcare deals where reliable price to revenue and/or EBITDA multiples are disclosed publicly.

-

Each acquisition target is categorized by broad segment and detailed "type" to support filtering.

-

Information collected includes names of the parties, date, state, ownership percentage, deal value, revenue and/or EBITDA, and a description of our sources with links.

Download database with financial details and sourcing documentation removed

M&A Volume Database

This database tracks all publicly announced healthcare services transactions, including deals where financial details are not disclosed.

-

Each acquisition target is categorized by broad segment and detailed "type" to support filtering.

-

Announcement dates and names of the parties are tracked as well.

-

Pivot table included to track announced deal volume by segment and type.

Download healthcare services database sample from the first half of 2022

Other Databases

Subscriptions also include a variety of other database resources, such as:

-

Fairness Opinion Database

-

Hospital Affiliation Database

-

Intangible Asset Database

-

Healthcare Real Estate Valuation Database

Trusted by healthcare's top M&A and valuation professionals

Anatomy of our analysis

Categorize in detail each publicly announced healthcare deal

Source reliable deal values on a total EV basis and reliable revenue / EBITDA figures

Share the resulting

data in an easy to use format with analytical tools and links to source documents